Business Insurance in and around San Jose

Researching coverage for your business? Look no further than State Farm agent Jim Edington!

Helping insure businesses can be the neighborly thing to do

Help Protect Your Business With State Farm.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Jim Edington help you learn about excellent business insurance.

Researching coverage for your business? Look no further than State Farm agent Jim Edington!

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are an optometrist or a painter or you own a pizza parlor or an advertising agency. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Jim Edington. Jim Edington is the agent who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

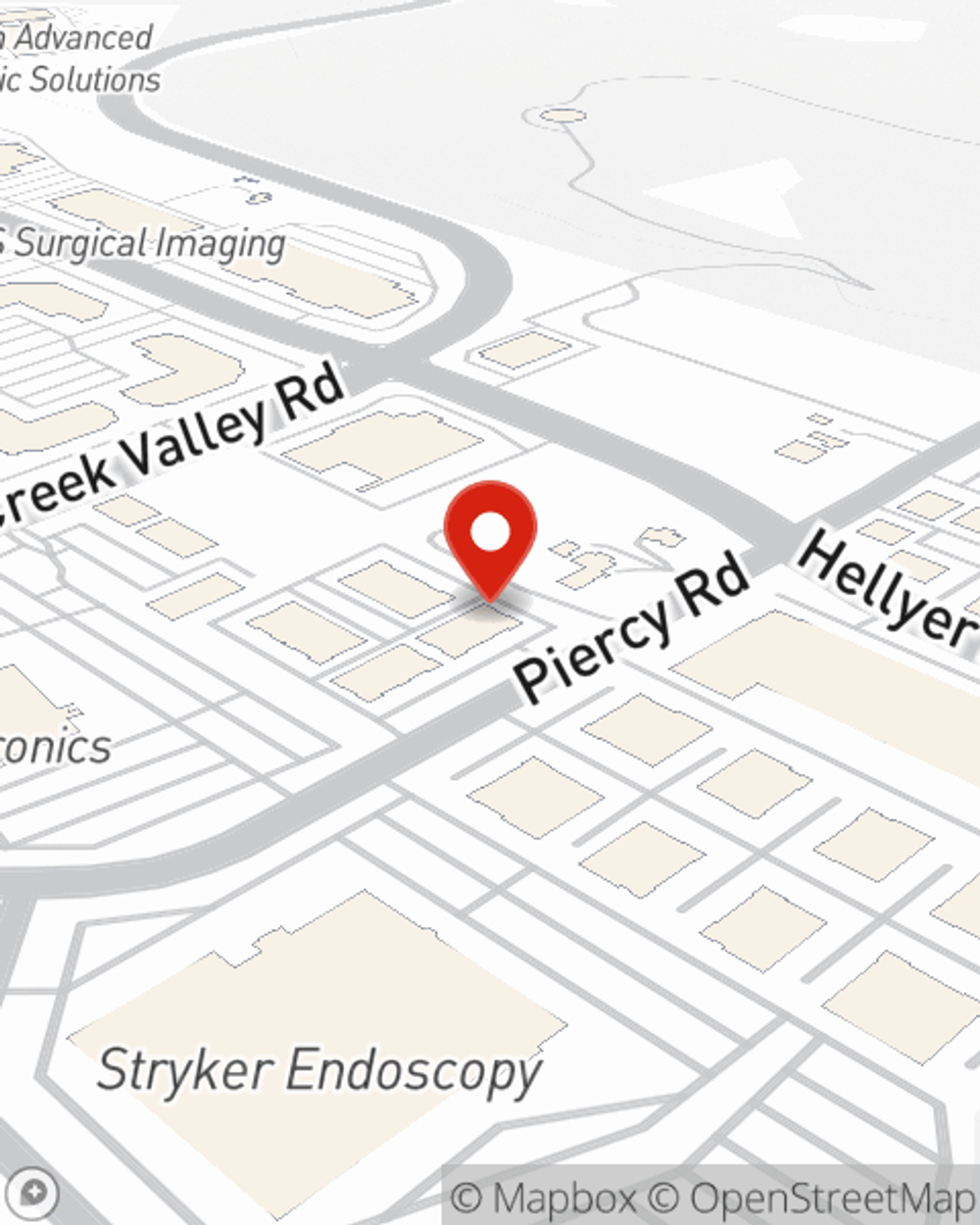

Reach out to the terrific team at agent Jim Edington's office to explore the options that may be right for you and your small business.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Jim Edington

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.